Canadian Family Budgeting 101

Essential principles for creating your first family budget in Canada, including understanding variable expenses and setting realistic financial goals for your household.

Expert guidance, practical templates, and proven strategies to help Canadian families build secure financial futures through smart budgeting and expense management.

Expert-curated content to help you build and maintain effective family budgets

Essential principles for creating your first family budget in Canada, including understanding variable expenses and setting realistic financial goals for your household.

Smart strategies for reducing your grocery bill by 30% while maintaining healthy eating habits for the whole family, including meal planning and bulk buying tips.

Step-by-step guide to building a solid emergency fund that protects your family from unexpected expenses and provides peace of mind for Canadian households.

Comprehensive budgeting solutions designed specifically for Canadian families

Master the fundamental budgeting categories that every Canadian family needs to track for financial success and peace of mind.

Learn the time-tested envelope method adapted for digital banking and Canadian spending patterns to control expenses effectively.

Never miss a payment again with our comprehensive bill tracking system designed for Canadian billing cycles and due dates.

Advanced expense categorization and tracking methods that help Canadian families identify spending patterns and opportunities.

Build sustainable saving habits that work with Canadian tax systems, RRSPs, and family financial planning goals.

Budget for Canadian seasons including winter heating costs, summer vacation expenses, and back-to-school spending.

Most-read budgeting guides and practical tips from Canadian families

Create shared financial goals that motivate everyone and strengthen your family's commitment to budgeting success.

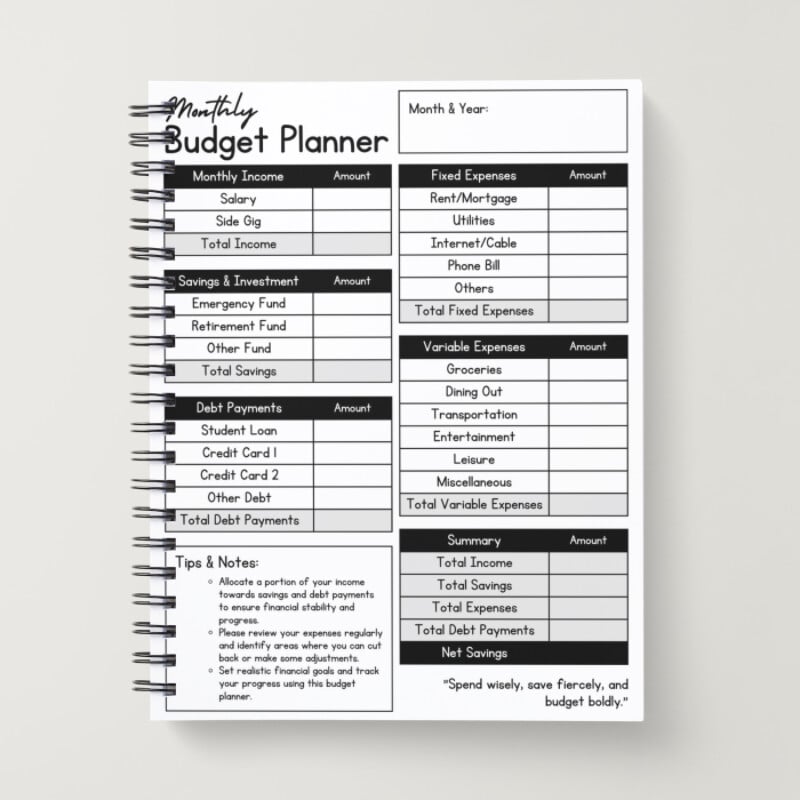

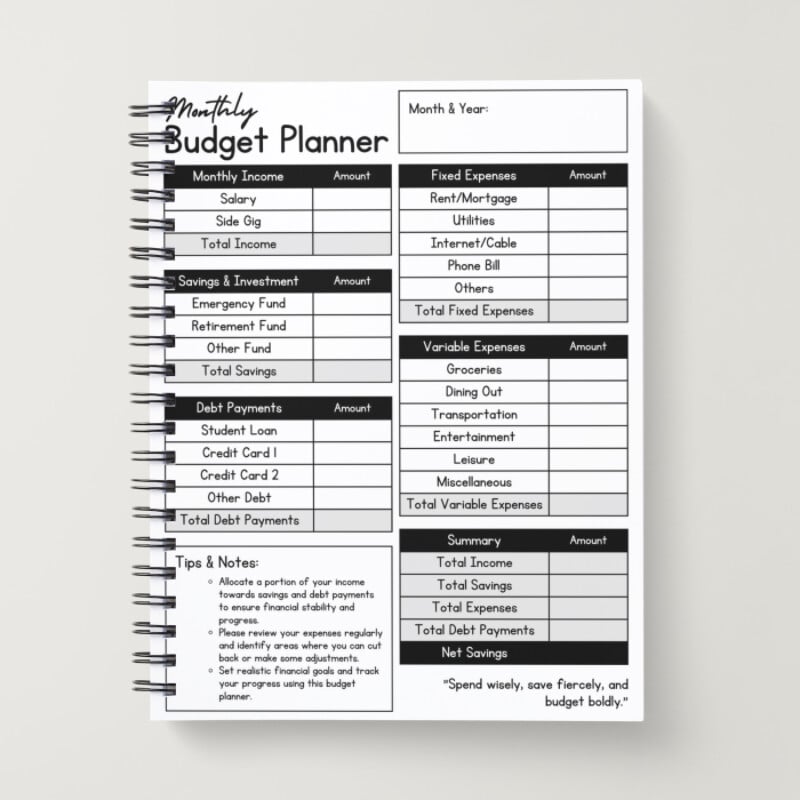

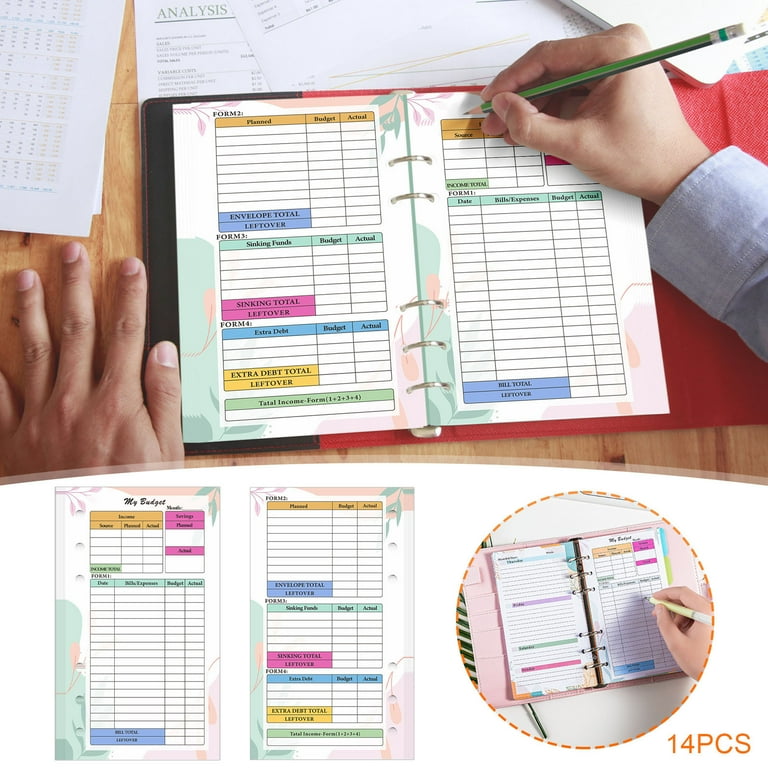

Download and customize our proven monthly budget template designed specifically for Canadian household expenses.

Transform your grocery budget with strategic meal prep techniques that save time and money for busy Canadian families.

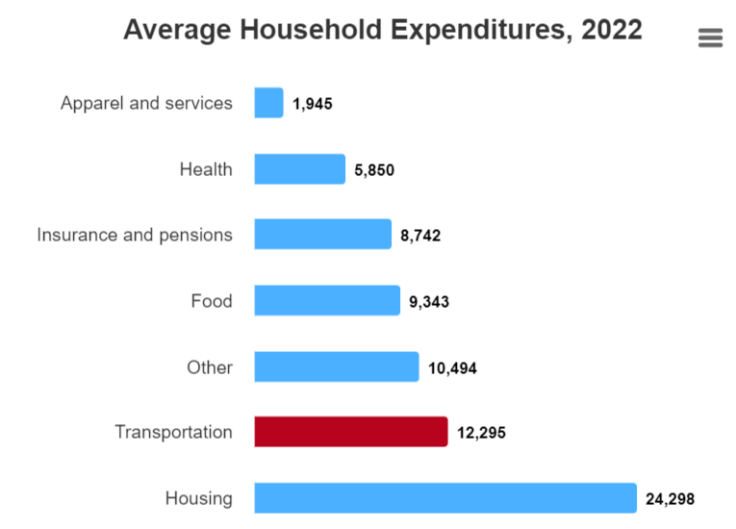

Optimize your family's transportation costs including car payments, insurance, fuel, and public transit expenses in Canada.

Navigate back-to-school expenses with confidence using our comprehensive budget planning guide for Canadian families.

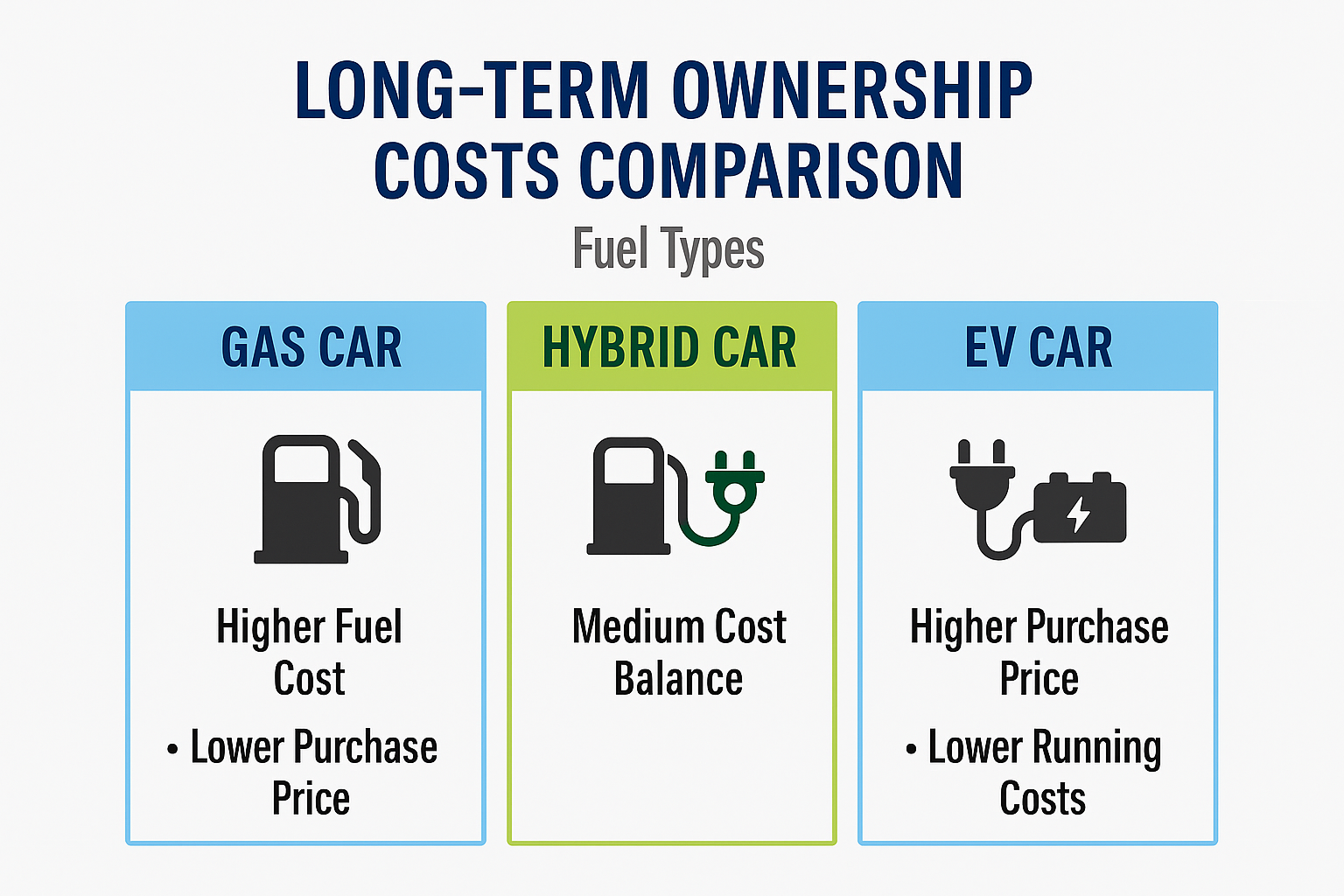

Compare true costs of gas, hybrid, and electric vehicles to make informed decisions for your family's transportation budget.

Discover the best budgeting method for your family by comparing digital tools and traditional paper-based systems.

Plan memorable family vacations without breaking the bank using our step-by-step vacation budget framework.

Real stories from families who've transformed their finances with LedgerNest

"LedgerNest helped us save $400 monthly by optimizing our grocery and transportation budgets. The Canadian-specific advice made all the difference for our Winnipeg family."

"The emergency fund planning guide gave us the confidence to build a 6-month cushion. Now we sleep better knowing we're prepared for unexpected expenses."

"Back-to-school used to stress our budget, but the templates and planning guides made it manageable. Our kids now have everything they need without financial strain."

Stay updated with the latest budgeting strategies and Canadian financial tips

Comprehensive review of the best budget tracking applications available in Canada, comparing features, costs, and user experiences.

Save money while eating healthy by planning meals around Canadian seasonal produce and smart grocery shopping strategies.

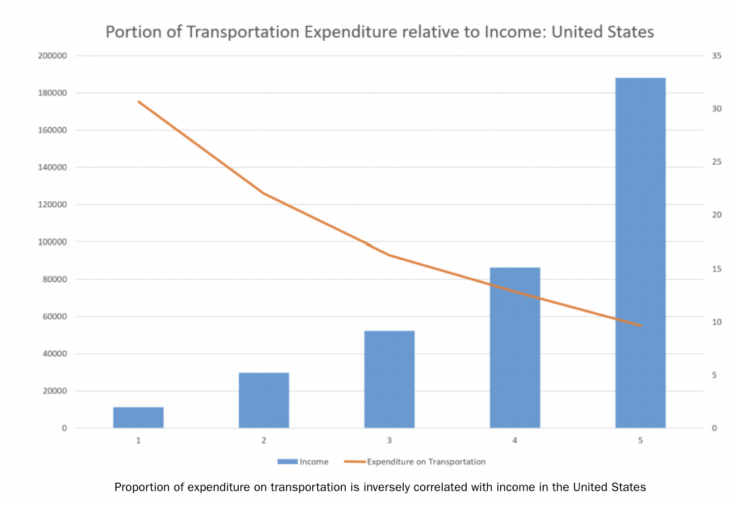

Learn how to allocate transportation spending based on your income level and optimize costs across different earning brackets.

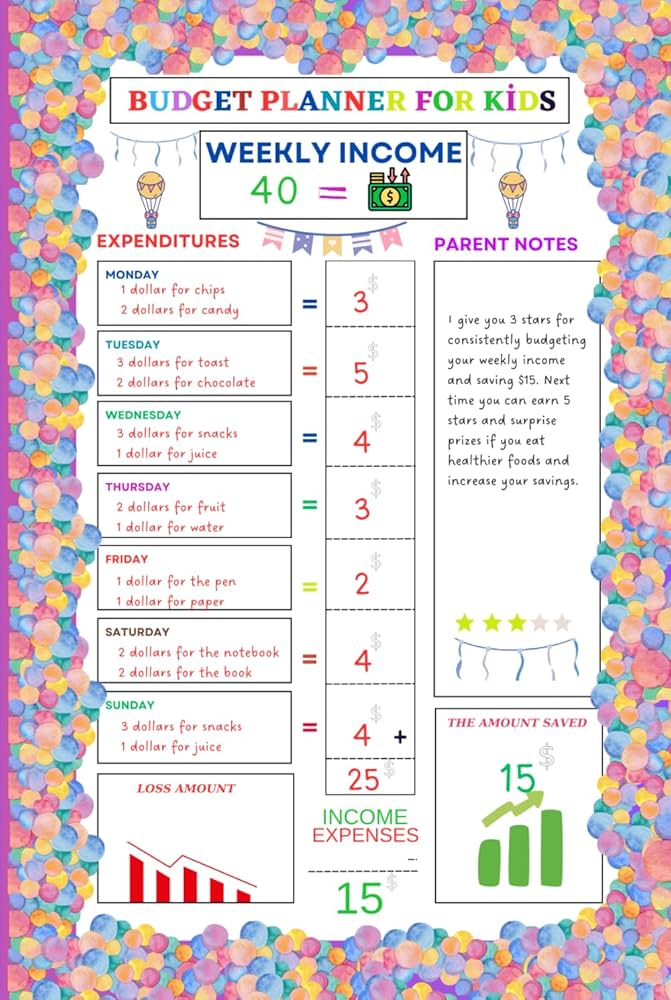

Age-appropriate strategies for teaching your children about money, budgeting, and financial responsibility in Canadian households.

Find budgeting resources tailored to your family's specific needs

Fundamental budgeting principles and getting started guides for new budgeters.

Manage your cash flow with smart income tracking and expense categorization.

Never miss a payment with our comprehensive bill tracking and due date management.

Optimize household expenses including groceries, utilities, and home maintenance costs.

Plan transportation costs and family vacations within your budget constraints.

Budget for children's expenses including school supplies, activities, and education costs.

Build financial security with emergency fund strategies and cushion planning.

Download practical budgeting templates, calculators, and planning tools.