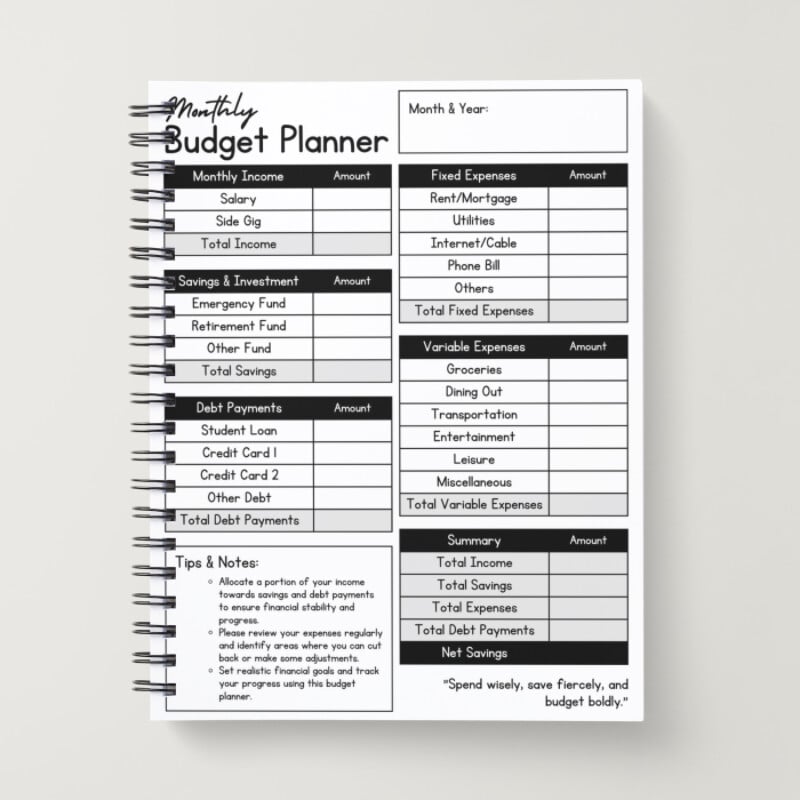

Multiple Income Stream Management

Effectively track and budget with multiple income sources including salaries, side hustles, and investment income, ensuring all money flows are accounted for in your family budget.

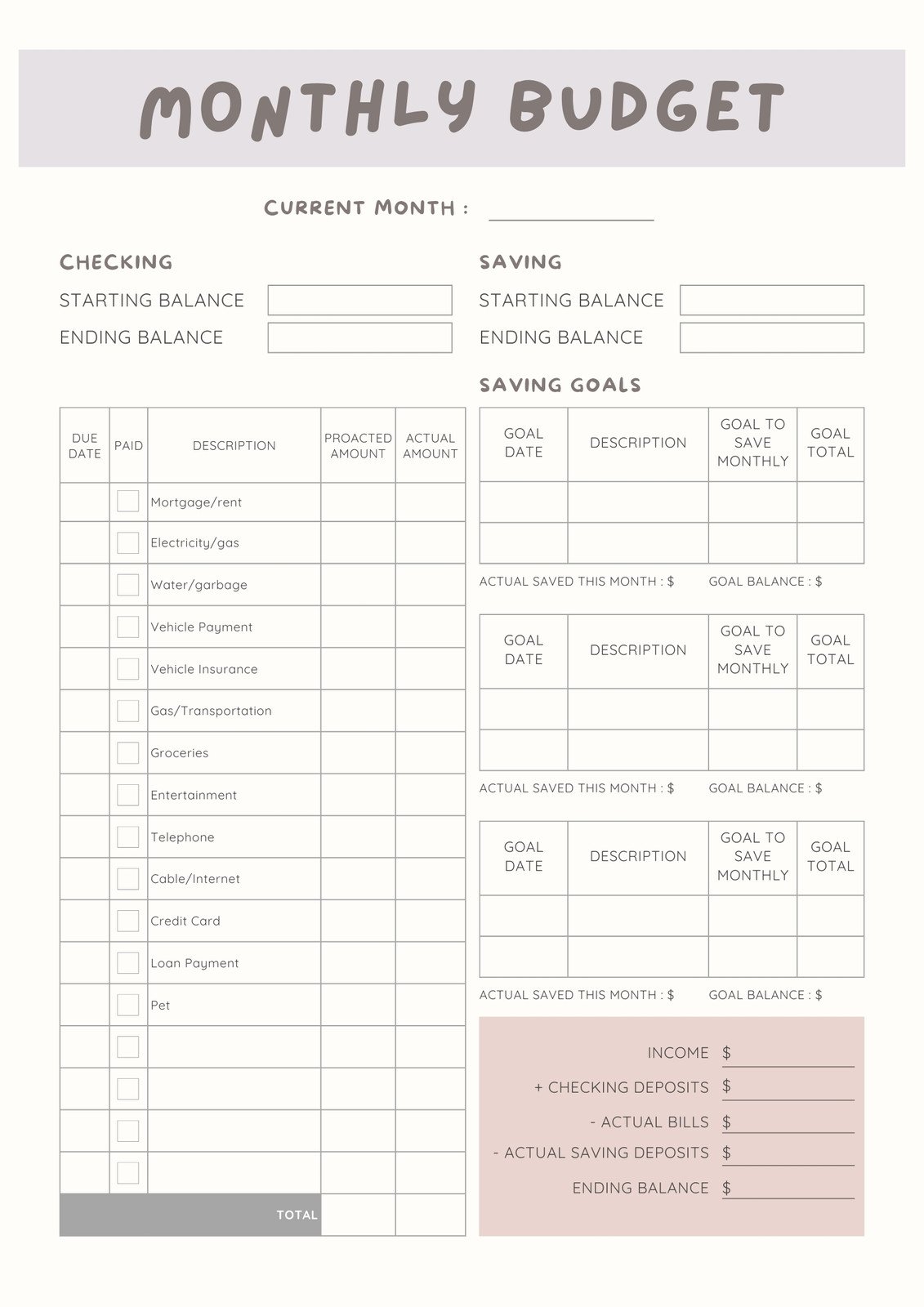

Master the art of cash flow management with our comprehensive guides to tracking income, managing variable expenses, and optimizing your family's financial flow throughout Canadian pay cycles and billing periods.

Effectively track and budget with multiple income sources including salaries, side hustles, and investment income, ensuring all money flows are accounted for in your family budget.

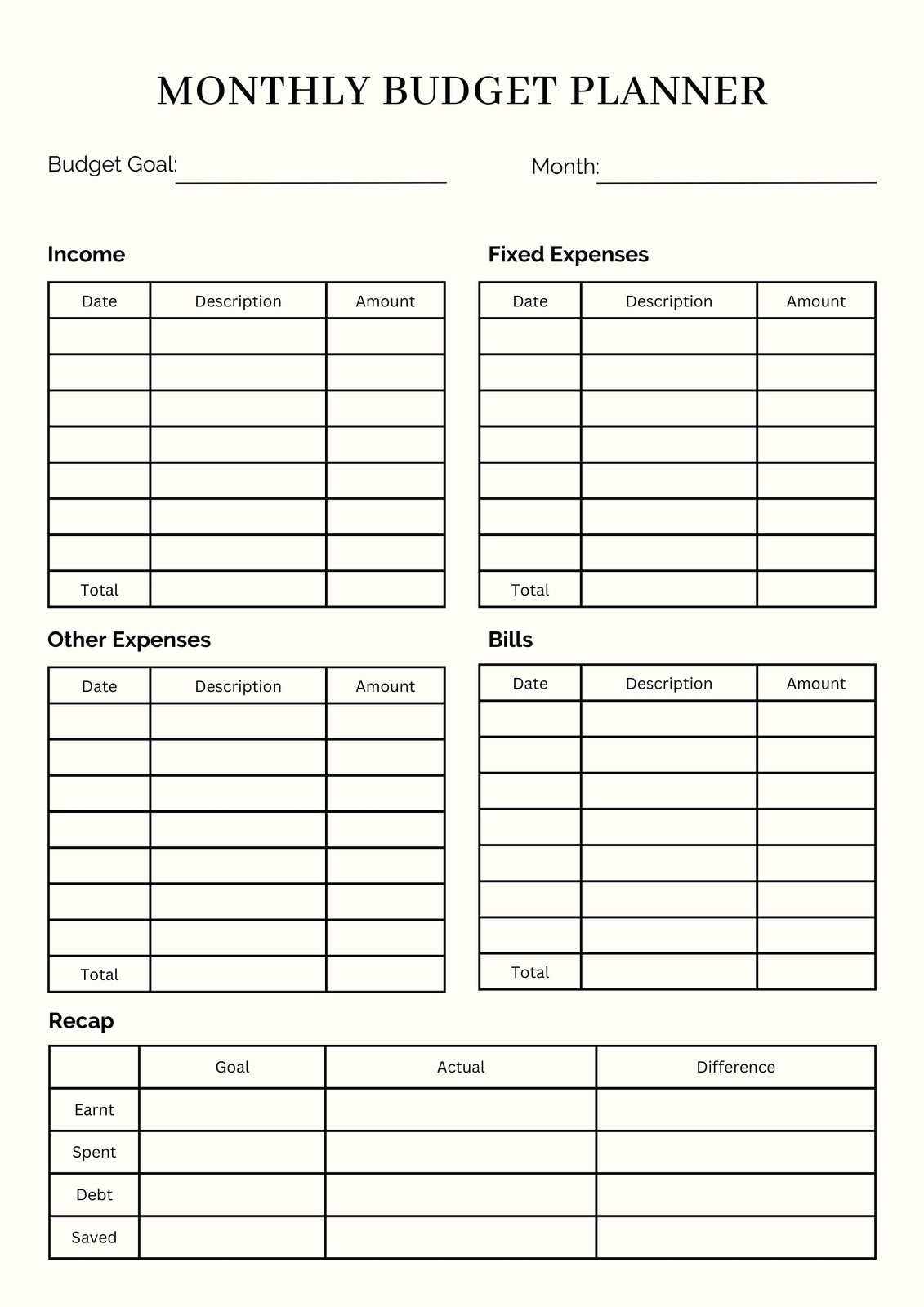

Learn to distinguish between fixed and variable expenses, create appropriate budget categories, and develop strategies to control unpredictable spending in Canadian households.

Master budgeting with Canadian bi-weekly pay schedules, including how to manage monthly bills that don't align with your pay dates and maintaining consistent cash flow.

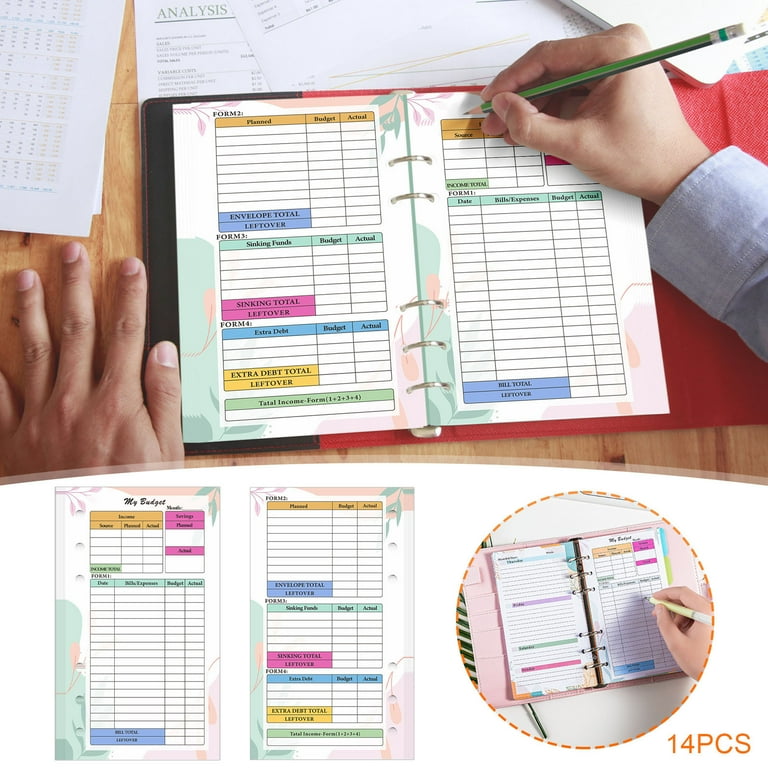

Create a comprehensive expense categorization system that works for Canadian families, making it easy to track spending patterns and identify areas for potential savings.

Plan ahead with cash flow forecasting techniques that help Canadian families anticipate future income and expenses, including seasonal variations and irregular payments.

Accurately calculate your take-home pay after Canadian taxes, deductions, and benefits to create realistic budgets based on actual available income rather than gross salary.

Compare the best digital tools for expense tracking available in Canada, from mobile apps to online banking features that automatically categorize and track your spending.

Establish a routine monthly meeting structure to review income, expenses, and budget progress with your family, creating accountability and shared financial awareness.

Adapt the traditional envelope budgeting method for digital banking and credit cards, creating virtual envelopes that help Canadian families control spending in each category.