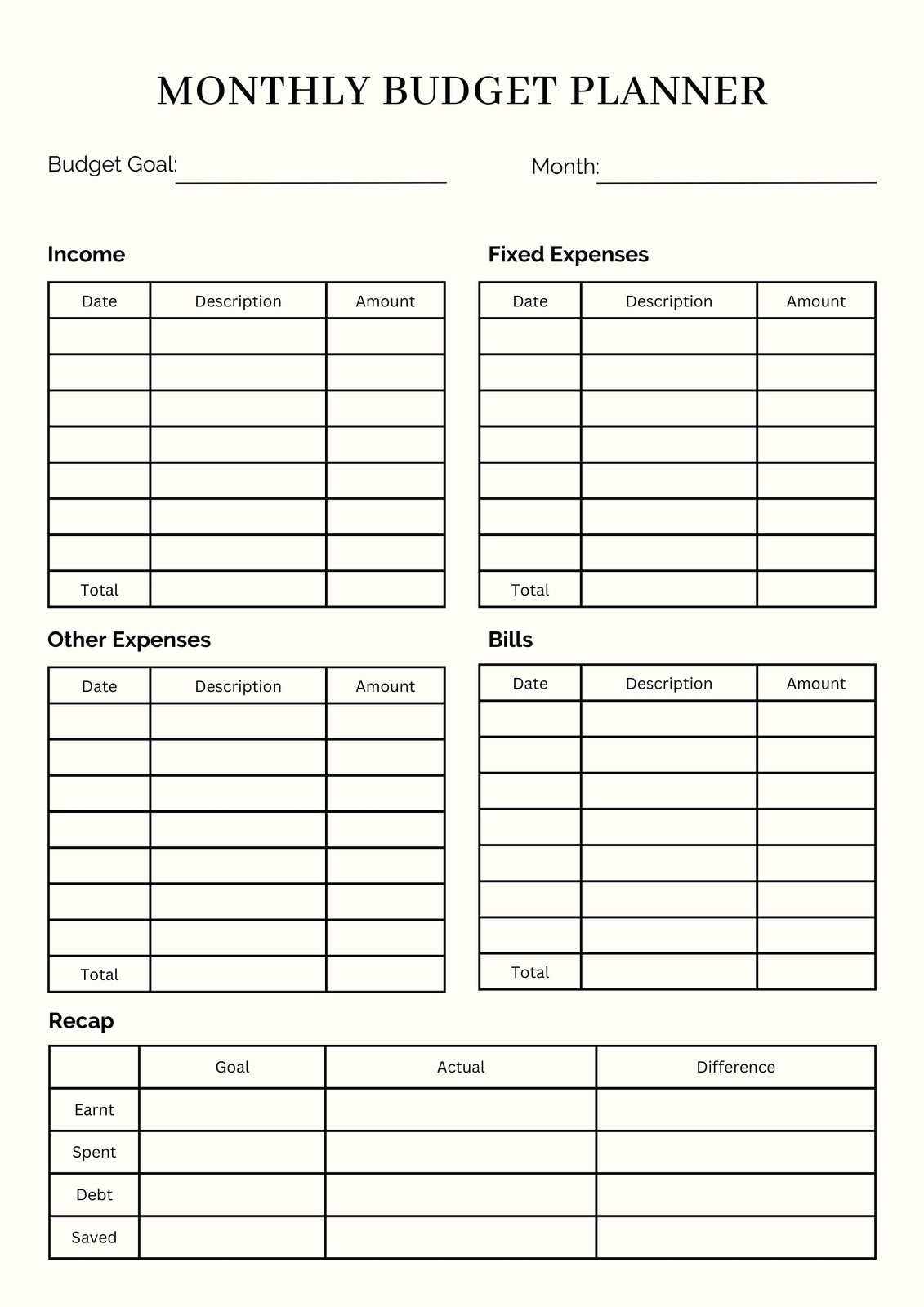

Annual Bill Payment Calendar

Create a comprehensive yearly calendar that tracks all your recurring bills, their due dates, and payment amounts, helping you plan cash flow and avoid last-minute scrambles for Canadian families.

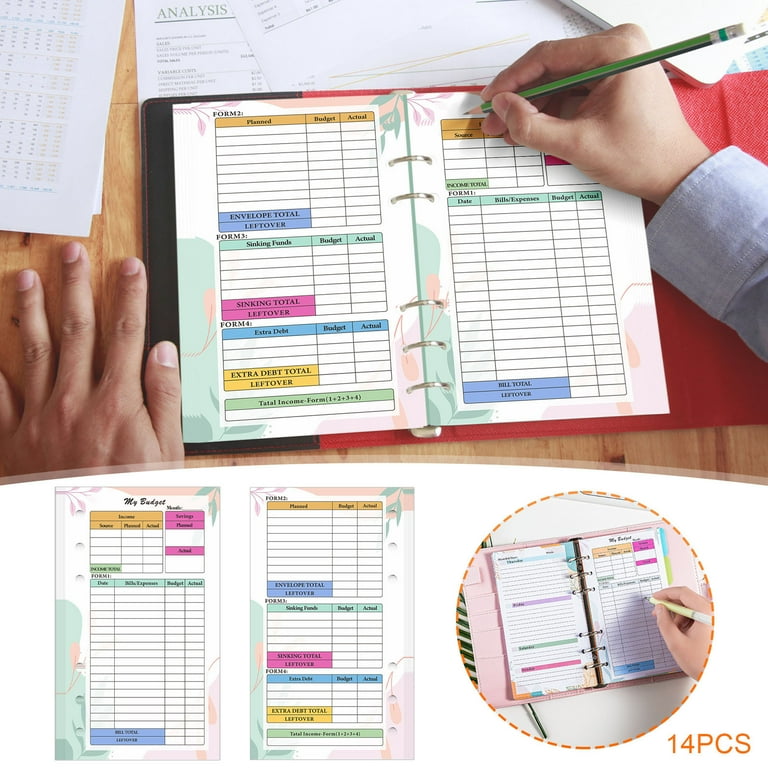

Take control of your bill payments with our comprehensive calendar system designed for Canadian families. Never miss a due date, avoid late fees, and maintain perfect payment history with organized bill management strategies.

Create a comprehensive yearly calendar that tracks all your recurring bills, their due dates, and payment amounts, helping you plan cash flow and avoid last-minute scrambles for Canadian families.

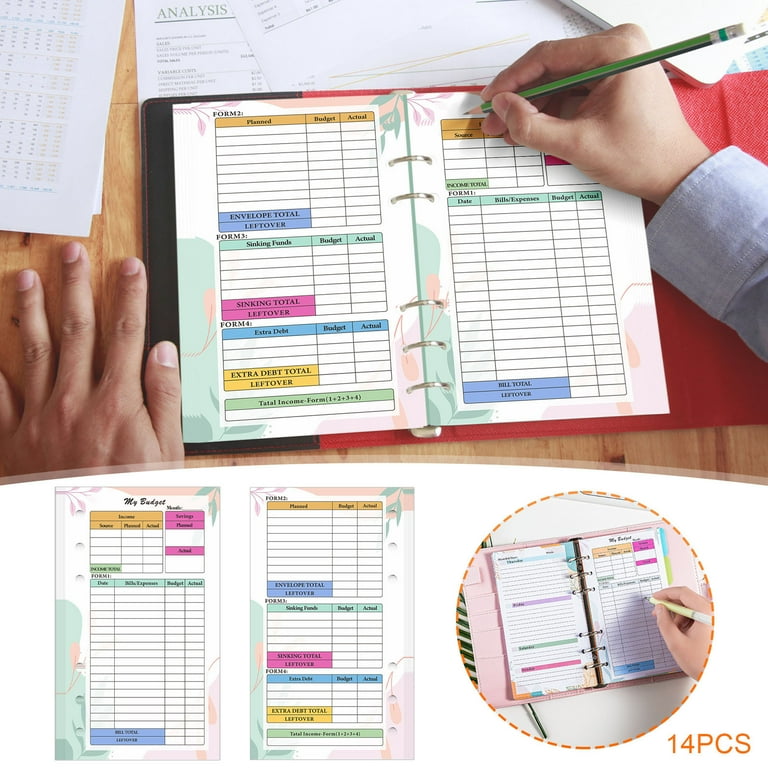

Learn strategies for tracking bill due dates including grace periods, optimal payment timing, and how to space out payments to match your family's pay cycle and cash flow needs.

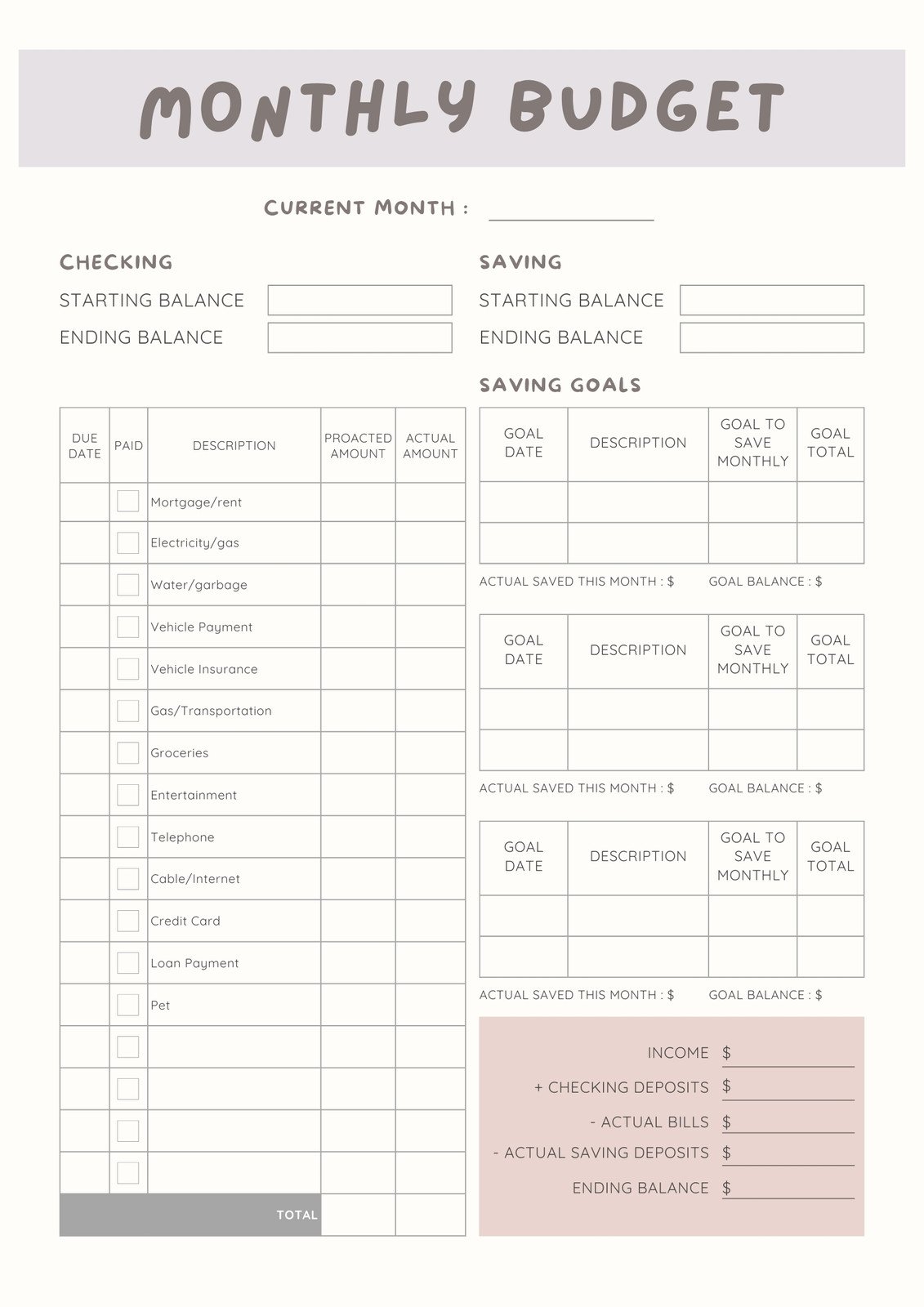

Navigate Canadian utility billing cycles including electricity, gas, water, and internet services. Learn about budget billing, equal payment plans, and seasonal variations in utility costs.

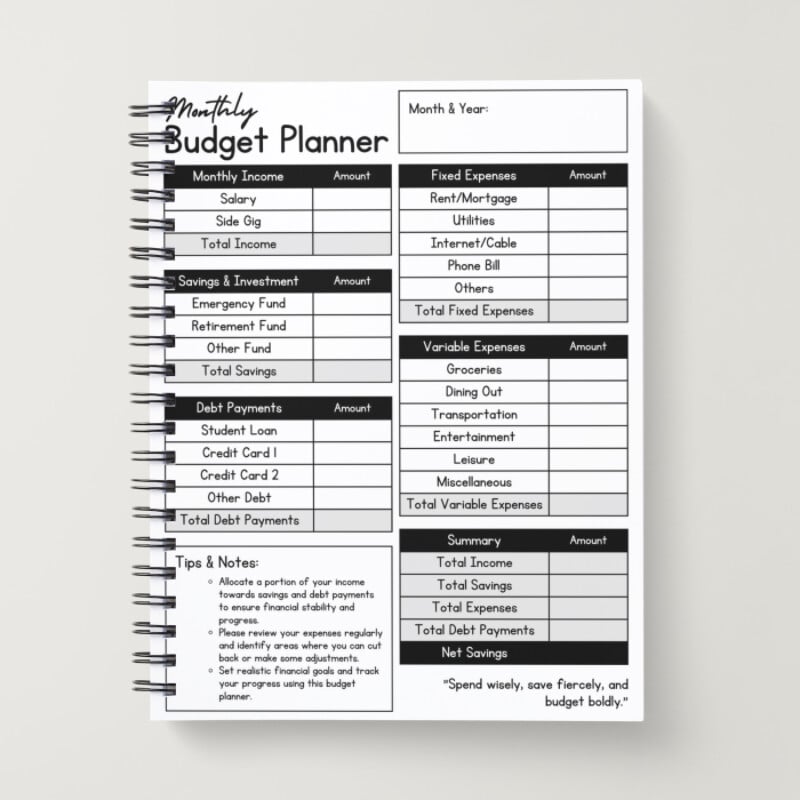

Weigh the pros and cons of automatic bill payments versus manual payment control, including cash flow management, building credit, and avoiding overdraft situations for Canadian families.

Review the best digital tools available in Canada for bill tracking, from banking apps with bill pay features to dedicated budgeting software that manages your entire financial calendar.

Create a dedicated fund to handle unexpected bill increases, emergency repairs, or times when regular income might be disrupted, ensuring your family's payment history remains clean.

Establish a weekly family routine to review upcoming bills, upcoming payments, and account balances, ensuring everyone stays informed and involved in the family's financial management.

Learn proven strategies to avoid late fees including payment buffer zones, grace period utilization, and emergency protocols for when unexpected expenses threaten your payment schedule.

Discover how to strategically time bill payments and potentially negotiate due dates to create a more manageable payment schedule that works with your family's cash flow and pay cycles.