The 50/30/20 Rule for Families

Discover how the popular 50/30/20 budgeting rule can be adapted for Canadian families, balancing needs, wants, and savings while accounting for taxes and family expenses.

Master the fundamental principles of family budgeting with our comprehensive beginner's guide. Learn how to create your first budget, set realistic goals, and build sustainable financial habits that will serve your Canadian family for years to come.

Discover how the popular 50/30/20 budgeting rule can be adapted for Canadian families, balancing needs, wants, and savings while accounting for taxes and family expenses.

Learn to create Specific, Measurable, Achievable, Relevant, and Time-bound financial goals that motivate your family and keep you on track toward financial success.

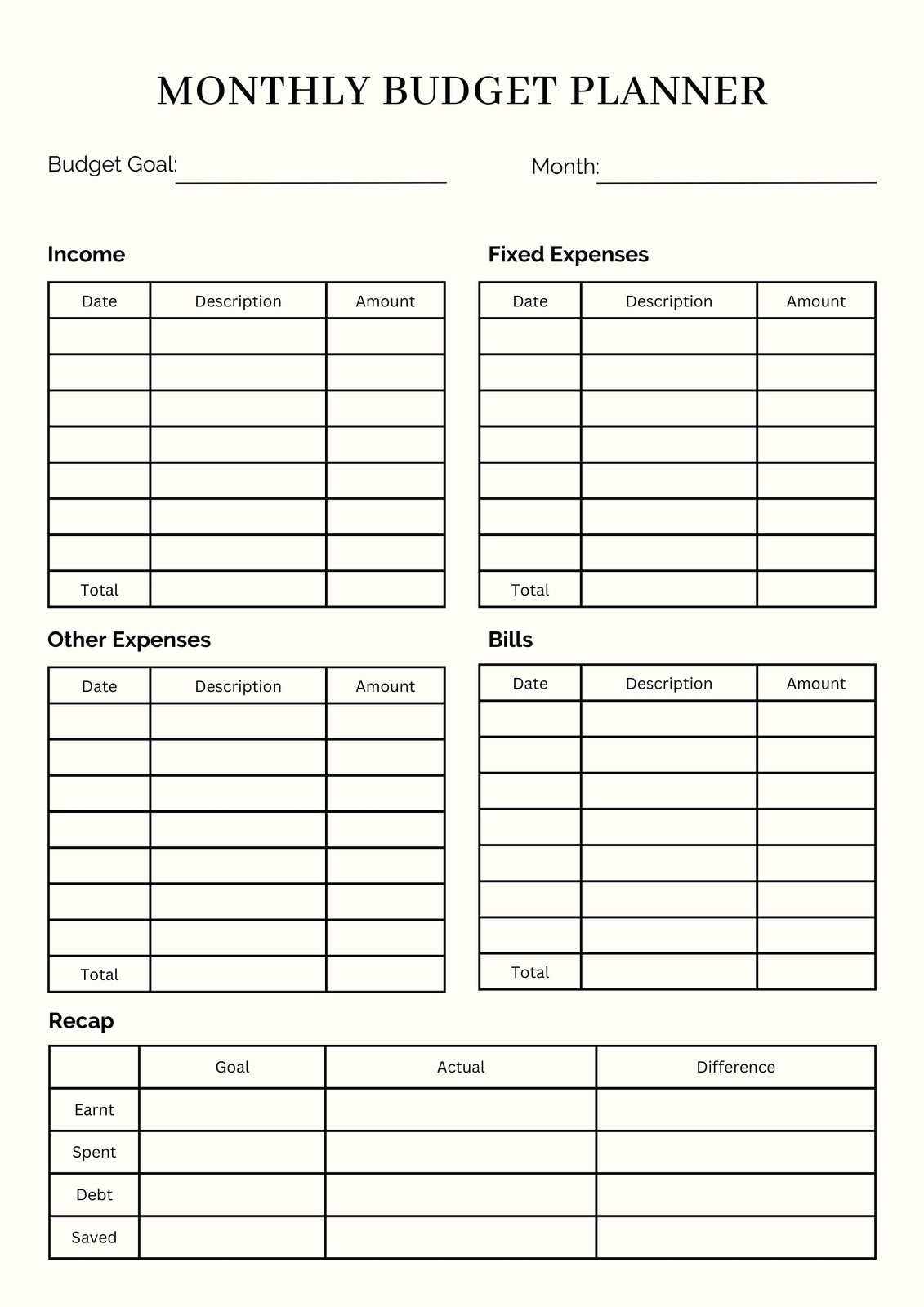

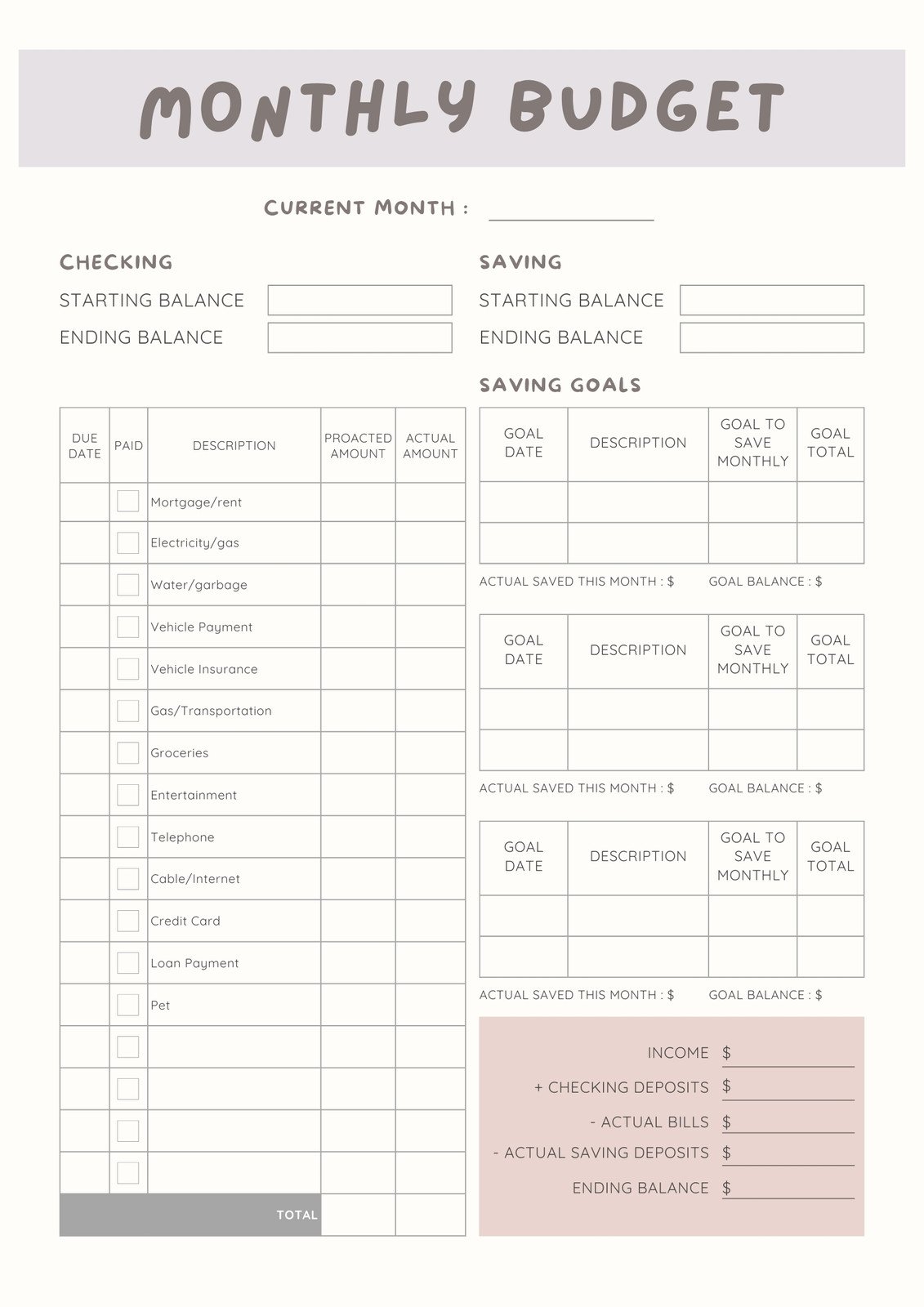

Master the must-have categories every Canadian family budget needs, from housing and utilities to savings and discretionary spending, with practical examples.

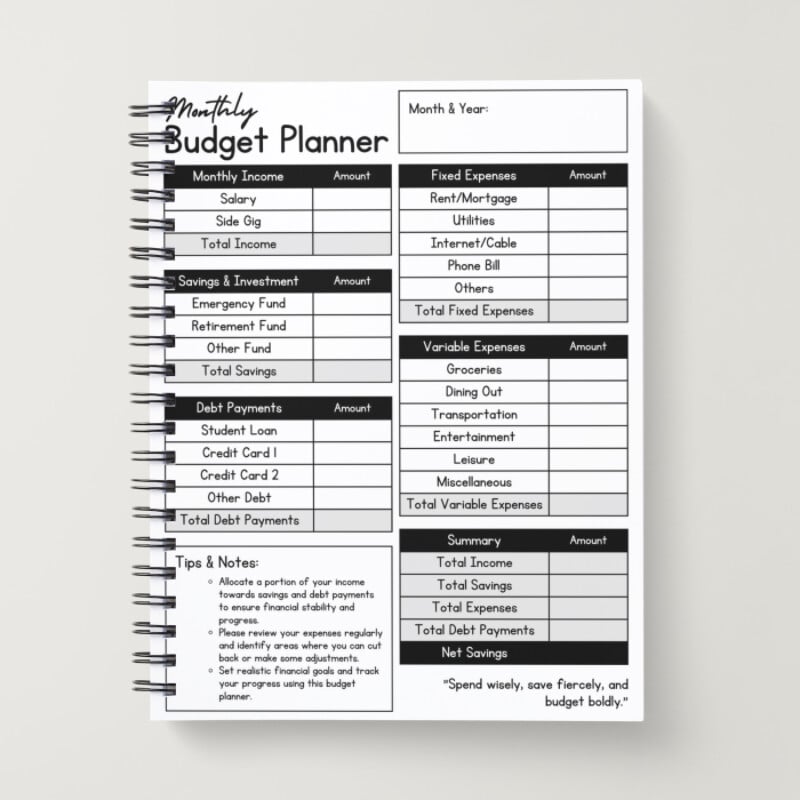

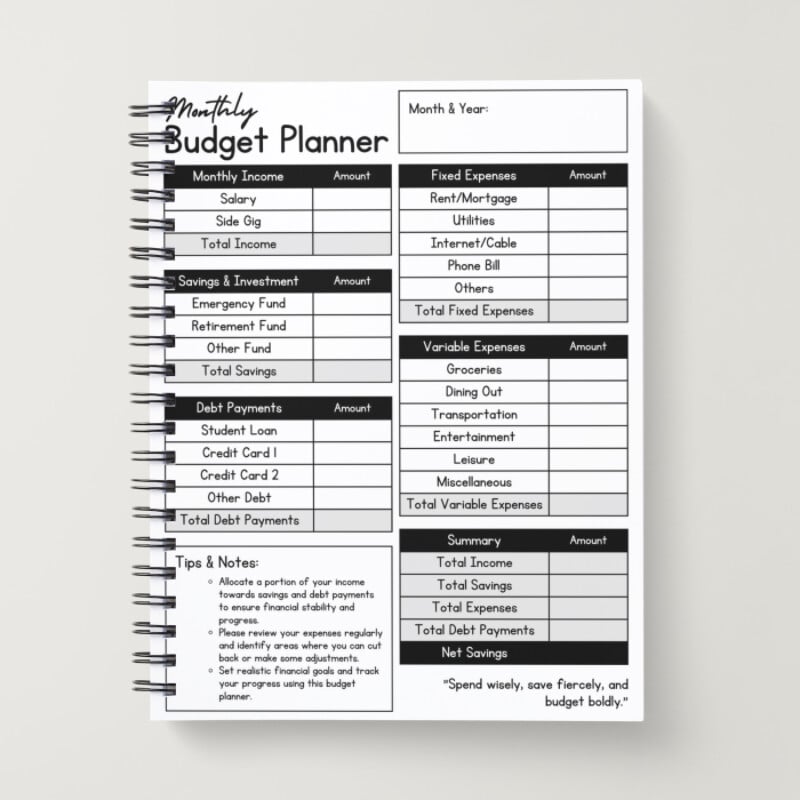

Compare digital apps, spreadsheet templates, and traditional paper budgeting to find the method that works best for your family's lifestyle and preferences.

Establish a consistent routine for reviewing and adjusting your budget each month, ensuring you stay on track and adapt to changing family needs.

Step-by-step guide to building an emergency fund that protects your family from unexpected expenses while working within your current budget constraints.

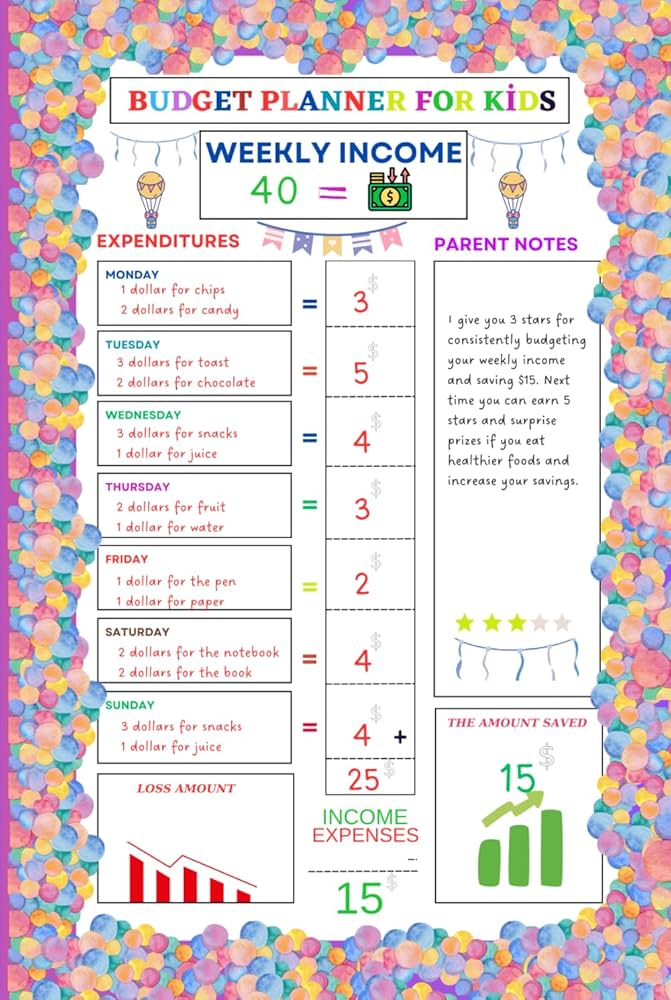

Age-appropriate strategies for getting your partner and children involved in family budgeting, creating financial awareness and shared responsibility.

Time-tested budgeting principles that work across different income levels and family situations, with adaptations for Canadian financial realities and tax implications.

Weigh the pros and cons of digital budgeting tools versus traditional paper methods to choose the approach that best fits your family's preferences and tech comfort level.