Setting Emergency Fund Goals

Determine the right emergency fund size for your Canadian family based on household size, income stability, health considerations, and regional cost of living differences across provinces.

Build financial security and peace of mind with a comprehensive emergency fund. Learn how Canadian families can create robust financial cushions to protect against unexpected expenses, job loss, and economic uncertainties while maintaining financial health.

Determine the right emergency fund size for your Canadian family based on household size, income stability, health considerations, and regional cost of living differences across provinces.

Navigate the balance between building an emergency fund and paying down debt, including when to prioritize each and how to make progress on both simultaneously for Canadian families.

Choose the best place to store your emergency savings including high-interest savings accounts, TFSAs, and other Canadian financial products that offer both accessibility and reasonable returns.

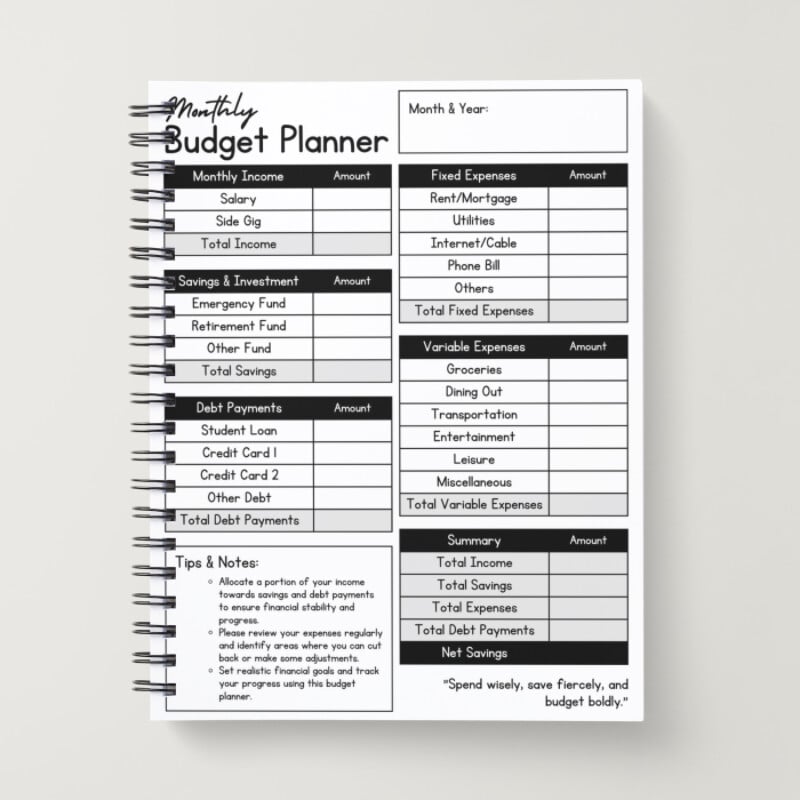

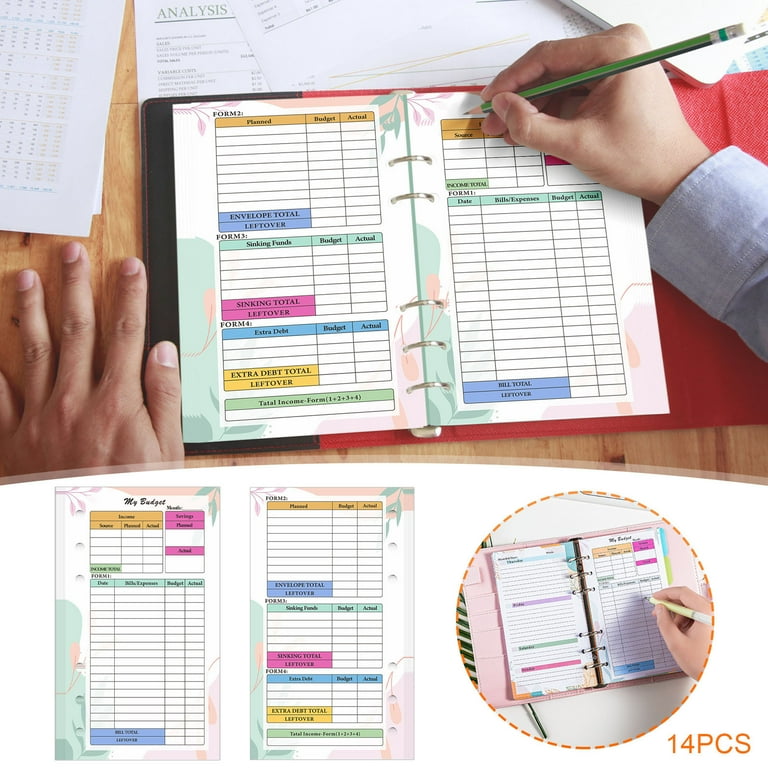

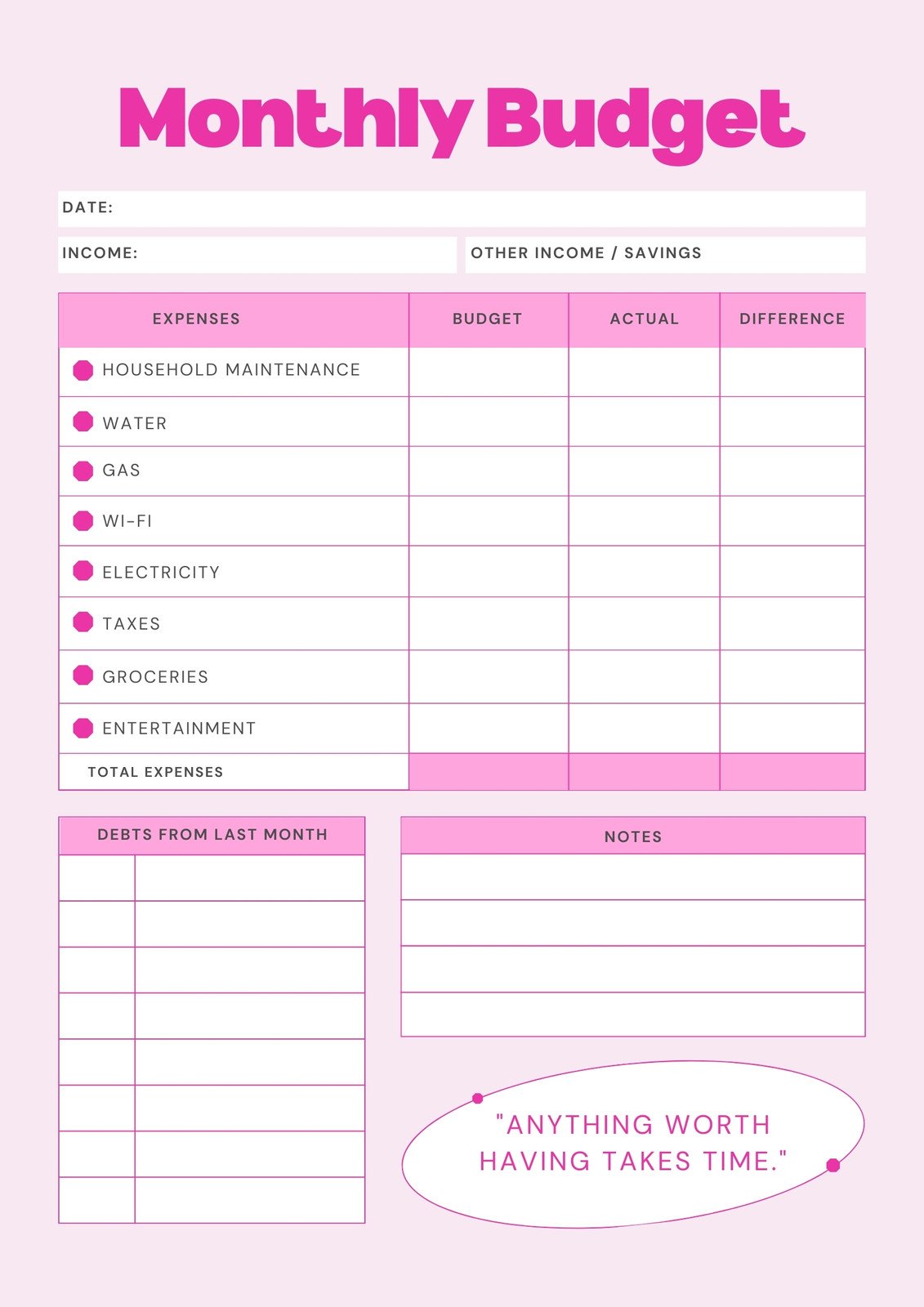

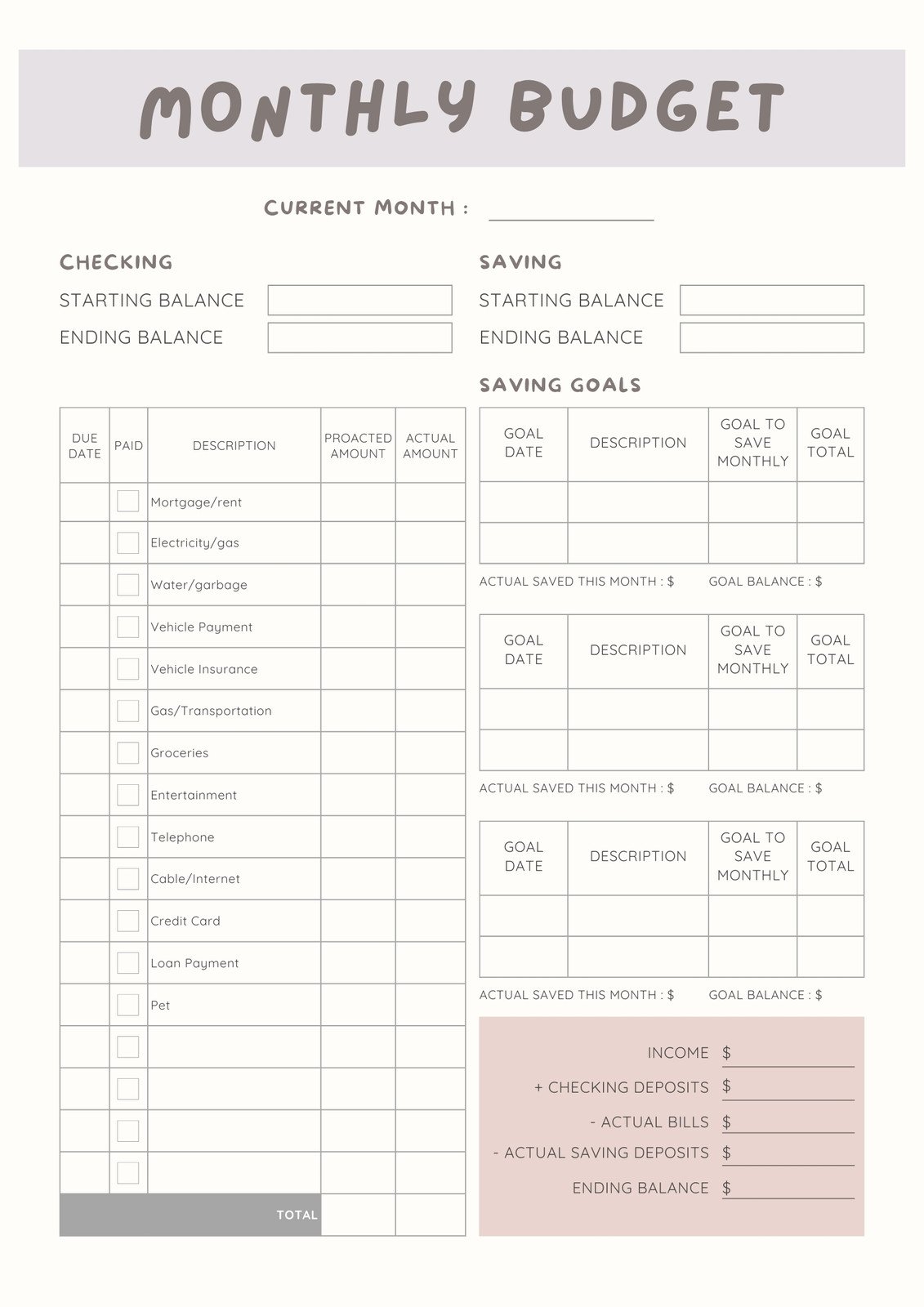

Create a systematic approach to building your emergency fund including automatic transfers, windfall allocation strategies, and realistic timelines that work with your family's budget constraints.

Define emergency expenses clearly to avoid dipping into your emergency fund inappropriately, including Canadian-specific emergencies like weather damage, medical costs, and job loss scenarios.

Celebrate and track progress toward your emergency fund goals including 3-month, 6-month, and full target milestones with realistic intermediate checkpoints for motivation.

Have productive conversations with your family about emergency preparedness including financial planning, emergency procedures, and ensuring everyone understands the importance of financial security.

Keep your emergency fund healthy including when and how to replenish it after use, adjusting target amounts as your family's circumstances change, and maintaining regular contributions.

Understand the psychological benefits of emergency fund ownership including reduced financial stress, improved sleep quality, and enhanced confidence in handling life's unexpected challenges.